Talking Points

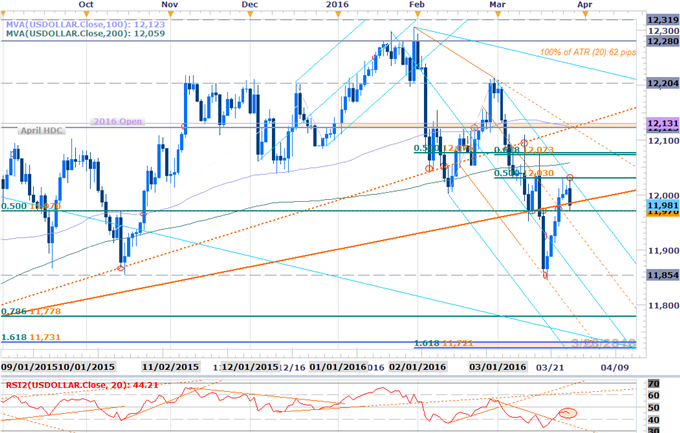

- USDOLLAR posts outside reversal candle off confluence resistance

- Immediate focus is on break of 11970-12030 range

- Updated targets & invalidation levels

USDOLLAR Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: The Dow Jones FXCM U.S. Dollar Index (Ticker: USDOLLAR) is attempting to mark an outside day reversal off confluence resistance at 12030. The index is coming off a 6-day advance from slope support at 11854 with our immediate outlook lower while within the confines of the descending median-line formation extending off the mid-January high.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the “Traits of SuccessfulTraders” series.

USDOLLAR 30min

Notes: A break below trendline support off the monthly lows shortly after the Asia open last night was accompanied with a support trigger-break in momentum, shifting the immediate focus lower. The decline is now testing interim confluence support at 11970 where basic trendline resistance off the monthly high (grey) converges on the 50% retracement of the May advance.

We’ll be expectiong a rebound here but remain on the lookout for short-triggers while below the upper median-line parallel / 12030. A break lower targets support obejctives at 11933 backed by 11888/91 & the lows at 11846/54. A breach of the weekly opening-range high invalidates the immediate short-bias with such a scenario eyeing initial targets at the 200-day moving average at 12059 & confluence Fibonacci resistance at 12073/76.

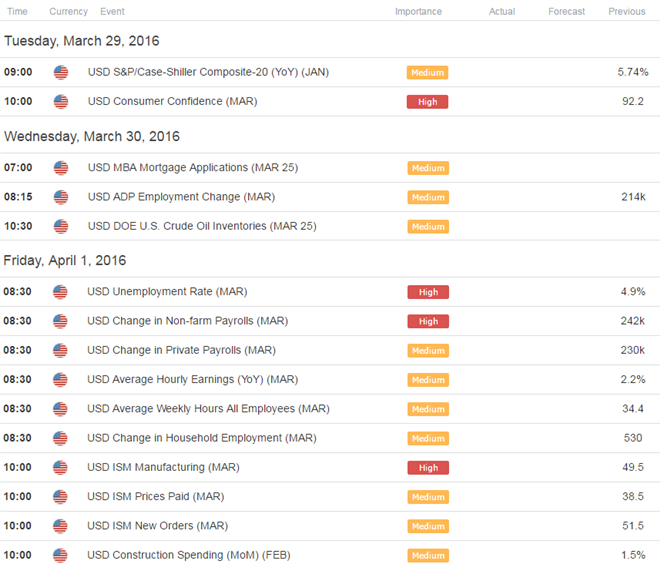

Event risk is limited ahead of Friday’s highly anticipated Non-Farm Payroll report where consensus estimates are calling for the addition of some 210K jobs for the month of March. Added caution is warranted heading into the close of the month / quarter as we’re likely to see increased intraday volatility. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Check out SSI to see how retail crowds are positioned as well as open interest heading into March trade.

Looking for trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

Relevant Data Releases

Other Setups in Play:

- Webinar: Month / Quarter End Setups- USD Crosses in Play Ahead of NFP

- AUD/USD in Correction- 7590 Key Resistance

- USD/CAD Low in Place? Breach Above 1.3240 to Confirm

- GBP/JPY Into Support Ahead of UK Retail Sales, Japanese CPI

- GBP/USD Eyes March High on Sticky UK CPI- Bullish Invalidation 1.4174

—Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

sumber:

0 komentar:

Posting Komentar