– U.S. Consumer Confidence to Rebound to 94.0 After Unexpectedly Slipping to 92.2 in February.

– Will Improved Household Sentiment Keep the FOMC on Course to Implement Higher Borrowing-Costs?

For more updates, sign up for David’s e-mail distribution list.

Trading the News: U.S. Consumer Confidence

A rebound in the Conference Board’s Consumer Confidence survey may boost the appeal of the greenback and spur a near-term decline in EUR/USD as it reinforces Fed expectations for a ‘consumer-led’ recovery in 2016.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Improved sentiment amongst U.S. households accompanied by a pickup in inflation expectations may encourage the Federal Open Market Committee (FOMC) to further normalize monetary policy over the coming months as the central bank appears to be well on its way to fulfil its dual mandate for ‘full-employment’ and price stability.

Expectations: Bullish Argument/Scenario

Signs of a stronger-than-expected recovery paired with the ongoing improvement in the labor market may push Fed Chair Janet Yellen and Co. to adopt a more hawkish outlook for monetary policy, and a positive development may largely fuel interest-rate expectations as the central bank appears to be on course to remove the emergency measures throughout the year.

Risk: Bearish Argument/Scenario

However, consumer confidence may continue to fall short of market expectations as U.S. households face subdued wage growth along with higher borrowing-costs, and another dismal print may spur a bearish reaction in the greenback as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk(Video)

Bullish USD Trade: Consumer Confidence Survey Advances to 94.0 or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD.

- If market reaction favors a bullish dollar trade, sell EURUSD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Household Sentiment Continues to Falter

- Need green, five-minute candle to favor a long EURUSD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

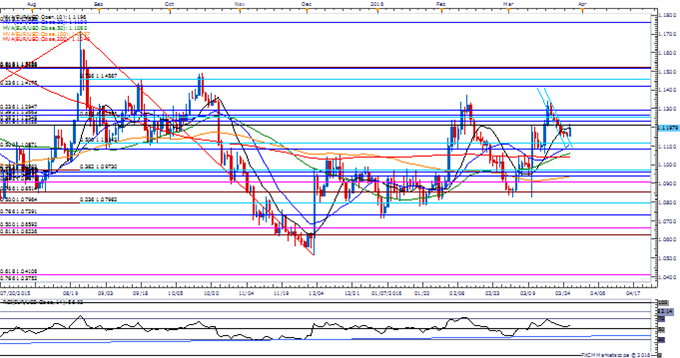

EURUSD Daily

Chart – Created Using FXCM Marketscope 2.0

- Even though the diverging paths for monetary policy casts a long-term bearish outlook for EUR/USD, the pair may work its way back towards the top of the 2015 range especially as the pair continues to close above 1.1090 (50% retracement) following the European Central Bank’s (ECB) March 10, with the exchange rate breaking out of the downward trend from the previous week.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Check out the short-term technical levels that matter for USDOLLAR heading into the report!

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the “Traits of Successful Traders” series.

Impact that the U.S. Consumer Confidence survey has had on EUR/USD during the last release

January 2016 U.S. Consumer Confidence

The Conference Board’s Consumer Confidence survey unexpectedly slipped to 92.2 from a revised 97.8 in January to mark the lowest reading since July. At the same time, 12-month inflation expectations narrowed for the fourth consecutive month in February, with the figure slipping to an annualized 4.7% from 4.8% during the same period. The downturn in household sentiment accompanied by the decline in inflation expectations dragged on the greenback, with EUR/USD coming off of the 1.1000 handle to end the day at 1.1017.

Read More:

COT-Small Traders Hold Largest AUD Long Position Since April 2013

GBP/USD – Waiting For a Catalyst

DailyFX Technical Focus: What is the USDOLLAR Index Doing?

Key Few Weeks for Silver Coming Up

Get our top trading opportunities of 2016 HERE

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

sumber:

0 komentar:

Posting Komentar