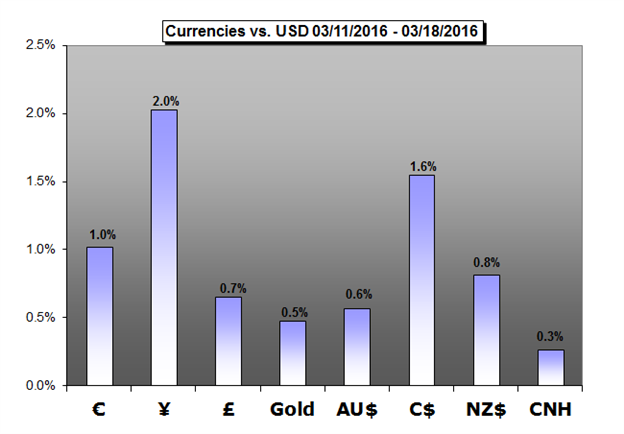

The Dollar’s tumble these past three weeks was given fundamental backing by the Fed’s downgrade of its interest rate forecasts. Does this mark a definitive turn in trend for the majors and risk trends?

US Dollar Forecast – Dollar Tumbles Third Straight Week, Is the Long-Term Bull Trend Over?

The Dollar has taken a nasty spill, but how do we reconcile the recent decline against years of rally and the proximity of a near-decade high?

Euro Forecast – Did Draghi Finally Find a Recipe For Strength?

The most recent European Central Bank meeting was a pretty big deal.

British Pound Forecast – GBP/USD Rebound to Accelerate on Sticky UK CPI, Shift in FX Sentiment

The near-term rebound in GBP/USD may gather pace in the week ahead should the key developments coming out of the U.K. economy put increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later.

Australian Dollar Forecast – Australian Dollar May Correct Lower After Hitting 9-Month High

The Australian Dollar may correct lower amid corrective capital flows and pre-holiday liquidity drain after hitting a nine-month high against its US counterpart.

New Zealand Dollar Forecast – NZD/USD Hits 2016 Highs As Fed Backs Off Aggressive Hike Path

The New Zealand Dollar hit 2016 highs this week on the back of a dovish Federal Reserve announcement where the number of expected interest rate hikes was lowered from four to two.

Chinese Yuan (CNH) Forecast – Yuan Outlook Bearish for Post-NPC Week

The Chinese Yuan pulled higher both on onshore (CNY) and offshore markets (CNH) against the greenback following the more dovish-than-expected comments from the Federal Reserve this week.

Gold Forecast – Gold Rally Capped Post FOMC- Bullish Invalidation 1194

Gold prices traded higher this week, with the precious metal advancing 0.58% to trade at 1256 ahead of the New York close on Friday.

What are the Traits of Successful Traders? See what our studies have found to be the most common pitfalls of retail FXtraders.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A’s, educational webinars, updated speculative positioning measures, trading signals and much more!

sumber:

0 komentar:

Posting Komentar