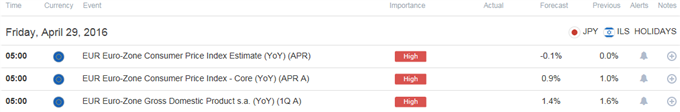

– Euro-Zone 1Q GDP to Expand Annualized 1.4%- First Slowdown Since 2Q 2014.

– Core Rate of Inflation to Slow to Annualized 0.9%.

For more updates, sign up for David’s e-mail distribution list.

Trading the News: Euro-Zone Gross Domestic Product (GDP)

A downtick in the Euro-Zone’s Gross Domestic Product (GDP) accompanied by signs of weaker price growth may undermine the near-term advance in EUR/USD as it fuels speculation for additional monetary support.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:Even though the European Central Bank (ECB) sticks to its current policy in April, fears of a slowing recovery may push the Governing Council to further embark on its easing cycle in 2016 as President Mario Draghi and Co. struggle to achieve their 2% target for inflation.

Expectations: Bearish Argument/Scenario

Waning business outputs paired with the slowdown in global growth may generate a dismal GDP report, and a marked slowdown in the growth rate may dampen the appeal of the single-currency as market participants boost bets for additional ECB support.

Risk: Bullish Argument/Scenario

Nevertheless, the pickup in household spending along with the ongoing expansion in private-sector lending may foster a better-than-expected growth figure, and a positive development may prompt the Governing Council to carry a wait-and-see approach into the second-half of the year as the economic outlook improves.

How To Trade This Event Risk(Video)

Bearish EUR Trade: GDP & CPI Report Highlight Slowing Recovery

- Need red, five-minute candle following the policy statement to consider a short EUR/USD trade.

- If market reaction favors a bearish Euro trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; need at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bullish EUR Trade: Growth , Inflation Figures Exceed Market Expectations

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bearish euro trade, just in the opposite direction.

Potential Price Targets For The Release

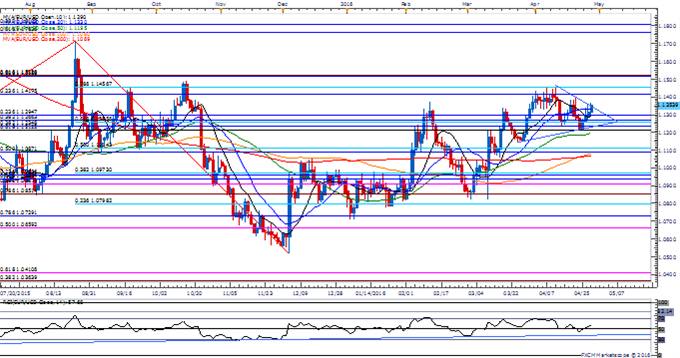

EURUSD Daily

Chart – Created Using FXCM Marketscope 2.0

- The recent series of higher highs & lows may continue to take shape in the days ahead as it threatens the triangle/wedge formation from earlier this month, while the Relative Strength Index (RSI) largely preserves the bullish formation carried over from March 2015.

- Interim Resistance: 1.1510 (50% retracement) to 1.1520 (61.8% expansion)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the “Traits of Successful Traders“ series.

Impact that the Euro-Zone GDP report has had on EUR/USD during the last release

4Q 2015 Euro-Zone Gross Domestic Product (GDP)

The Euro-Zone’s 4Q Gross Domestic Product (GDP) report showed the growth rate slowed to an annualized 1.5% after expanding 1.6% during the three-months through September, while a separate survey revealed a 1.0% contraction in Industrial Production during December amid forecasts for a 0.3% increase. Indeed, signs of a slowing recovery may encourage the European Central Bank (ECB) to further embark on its easing cycle in 2016 as the Governing Council struggles to achieve its one and only mandate for price stability. EUR/USD struggled to hold its ground despite the in-line print, with the exchange rate extending the decline during the North American trade to end the day at 1.1248.

Get our top trading opportunities of 2016 HERE

Read More:

Emotions Run High in Silver Trade

SPX500 Technical Analysis: Higher-Low Ahead of US Earnings

US DOLLAR Technical Analysis: Who’s Happier? Bears or Central Bankers

AUD/USD – Will the Real Trend Please Stand Up?

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

sumber:

0 komentar:

Posting Komentar