What’s inside:

- Market finally takes a breather, S&P 500 turns lower from resistance

- Bellwether Nasdaq 100 stocks report disappointing earnings

- Technical topping formation triggered, but need to tread carefully

On Thursday, the market finally took a breather, and as it turned out the “spinning top” bar formation in the S&P 500 netted a good short-term signal thus far.

After the close of the cash session yesterday, by index weight roughly 18% of the Nasdaq 100 reported earnings, which is a whole two companies, three if you split Alphabet/Google (GOOGL/GOOG) into two (which they did). Microsoft (MSFT) was the other. Without going into all the messy details of their quarterly results, let’s just summarize by saying they disappointed.

The break in those bellwether names sent the Nasdaq 100 futures sharply lower into the final minutes of the day session, which now amounts to a break in the ‘neck-line’ of a ‘head-and-shoulders’ pattern. The index has been lagging for a while now, and with yesterday’s late-day events it should lead the way on the downside if we are to see follow through in the broader market.

Nasdaq 100 1-Hour

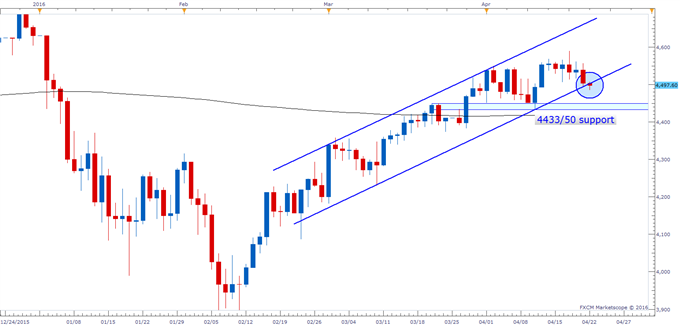

We do need to be cognizant of a couple of things before we get too excited about thinking the market might tank here. First, this market has been extremely resilient on pullbacks, and if it is to continue that trend this decline may be viewed as an opportunity to buy. Secondly, the break has taken the Nasdaq (FXCM: NAS100) to a lower parallel of a channel dating back to 2/24. So, despite a clean break in a usually trust-worthy technical pattern, we need to still tread carefully.

Daily

With that said, though, if market participants fail to view this as an opportunity to pick up stocks on the cheap today, then sellers could get restless and start hitting bids through channel support. If this is the case, then the 4433/50 area will become our objective, as it coincides nicely with a measured move target for the H&S formation as well as actual price levels.

Looking for longer-term views? Check out our quarterly forecasts here.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter @PaulRobinsonFX, or email him directly at probinson@fxcm.com with any questions, comments, or concerns.

sumber:

0 komentar:

Posting Komentar